POC for White Knights

Company Brief:

Recruitment as a service may be commonplace but competence in recruitment, the real knack to source quality manpower is a skill one doesn’t come by very often. White Knights with its strong corporate ties to the $10 million Pragati Group was put together in 2011. In a relatively short duration, White Knights has managed to clock over 2000 deployments having been associated with some leading corporates.

As partners in your success, we make it our business to understand your operation and your manpower needs. From there we take on the entire recruitment process from profiling the job to hunting for prospectives to testing them throughly and passing them on to you for deployment. By doing this, we not only blindly hunt for manpower, but are capable of objectively discussing and analysing your requirement thereby opening up the possibility of healthy downsizing which saves you both, time and money.

Our responsibility doesn’t end at just offering you the right set of candidates. As an organisation, White Knights makes it a point to conduct regular internal audits to ensure our process is in line, and up-to-date with our client’s best interest.

Temporary Staffing:

The need for emergencies lead to the advent of the temporary staffing format of recruitment. However, of late, temporary staffing has been utilised by companies looking to deploy a team on a project based job for a predetermined duration. White Knights offers you the flexibility of both temporary and permanent staffing while keeping quality intact.

Contracts and Package planning:

Outsourcing your recruitment requirements to White Knights allows you to outsource practically all your staffing based concerns right from planning a candidates package, incentives to other contract based receivables. Simply put, the convincing process which is managing to get you the best bang for the buck is our responsibility!

Content for PCS Tech

About Us:

A Top Ranking IT Solutions Company :

PCS Tech, since its inception in 1983 has built a global footprint for itself with 22 offices strategically spread across the world. At PCS Tech, our business is innovation driven wherein we assess, understand and improve our client’s business and the processes within with simple and workable technology based solutions. Our solutions not only improve client side productivity but endeavour to do so at a very affordable price point, both development and maintenance wise.

Focus on Customer Delight

Innovation with technology and the changes the solutions lead to have a way of simplifying mundane, rather difficult to manage tasks. At PCS Tech, we make it our priority to identify redundant areas in our client’s business process and make them fun to deal with using our solutions. We have achieved significant results keeping our services ‘Customer Delight’ centric and testimony of this lies in our pool of Fortune 500 clients who have chosen us time and again.

Partnering with Global Leaders

In keeping with our goal to be a well rounded technology firm thats up to speed with current standards, we at PCS Technology feel it imperative to build strategic alliances with industry leaders. This helps us offer a more matured service pool while improving geographical reach as well.

Vision & Mission:

Vision:

It is our Vision at PCS Tech to emerge as one of the top 5 information technology service providers in the world, a company that focusses on unique solutions and services while staying competitive and offering continuous improvements on an on-going basis. While offering market leading solutions, it is our intention to continue to stay a knowledge and learning oriented organisation, to expand our abilities by empowering and education our human resource pool, the new generation human essence of PCS Tech.

Mission: Building Commitment | Recognition

Our mission as a team is to focus on small steps that win over our client’s confidence and nurture faith. Our solutions and services are strong, intertwined with our values make for an ideal model of commitment. PCS Tech has in the past and continues to strive at bagging key accolades and awards that add value to our services and strengthen our position to achieve our Vision.

Key Differentiators:

PCS Tech is focussed on solutions and services relating to information technology. That is a job we take very seriously and all of our efforts are essentially aimed at improving our influence and effectiveness in this area of business. Since 1983 with over 32 years of experience we have emerged as India’s 3rd largest IT service provider. Having been listed on the Bombay Stock Exchange in 1998 we boast of over 1000+ satisfied customers. PCS Tech is backed with the coveted ISO 9001:2008 quality certification. Our overseas presence in the US, Europe, Australia and the Middle East along with an extensive service network of 450+ locations in India make us unmatched in our service reach potential.

Quality:

Apart from the various formal measures the management of PCS Tech believes in, within the quality sphere, we constantly arrange refresher courses and short training modules for employees to keep in sync with advancements. The management of PCS Tech believes in nurturing team spirit among staff and tackling client side requirements while keeping in mind a wider perspective (project wise). Our ISO 9001:2008 certification compels us to undertake regular internal and periodic external audits to ensure processes are being followed as per published manuals and SOPs.

Services:

Infrastructure Management Services (IMS):

Remote Support Center:

The IT Infrastructural requirements that today’s business demands can be overwhelming. Furthermore, it is common knowledge that troubleshooting is far more essential to master than the process itself. Our Remote Support Centre is based on the Detect, Interpret, Notify and Perform principle. The single point service desk is capable of handling work orders and all customers are given a single point of contact for their troubleshooting or service related needs. Customers are given an easy-to-understand user interface cum dashboard which tells them the overall health of services provided including reporting of problem areas. (Map not included in content)

Workplace Support:

Consider a workplace with several hundred nodes / computers speaking to each other over a local network. There are many ways to achieve this framework, all differently poised for different applications and uses. PCS Tech focuses on end user requirements by assessing your technology needs and determining what is best for your organisation. We assess your workplace IT framework, identify problem areas and endeavour to eliminate them with more intelligent and better planned IT infrastructures. Our Workplace Support solution ultimately saves a lot in terms of money and time and ensures minimum downtime which boosts productivity.

Data Center Services:

A Data Center requires accessibility, redundancy, security and a bullet proof user interface to make retrieval and storage as simple as possible. Companies are increasingly getting into decentralising their data off individual employee systems and moving it to a more secure, easily manageable location. At PCS Tech, we have had extensive experience in designing and maintaining data centres for some fairly large companies. These data centres have not only simplified the data access process but also improved equipment life owing to decentralising of data access load and reduced data theft owing to stringent security measures both physically and over the network.

Managed Maintenance Services:

Our equipment maintenance service is aimed at reducing the confusion and mismanagement that arises from dealing with multiple vendors. Furthermore, it cuts down instances of hardware and software piracy given that PCS tech deals only with OEM Hardware and Software.

Since we are empowered at one end only to handle all your IT real estate, our maintenance service enables us to pre-empt possible issues and troubleshoot the same before time and productivity is lost.

Our well spread network of service centres across 180 locations ensures we are never inaccessible during an emergency. PCS Tech’s Managed Maintenance services allows our customers to concentrate on their core business while leaving all their Hardware and Software service issues to us.

From our premium line of jackets and overcoats, we bring you the Park Avenue Solid Wool Rich Jacket. Whether its a life changing business meeting, your kid’s graduation ceremony or a best friends wedding, this jacket promises to make you look every bit as good as aristocracy. The Solid Wool Rich jacket comes in a variety of standard sizes and is Deep/Navy blue in colour. It is woven in 70% Wool and 30% Polyester.

Ever wondered if there were a pair of trousers woven for a bunch of occasions. The Poly Wool Sapphire Trouser by Color Plus is that and much more. The Pleat less design makes it ideal for casual wear to a club or a social gathering while the straight cut and contemporary fit makes it more than appropriate for everyday office use. These trousers come in a variety of standard sizes and are woven in 65% Polyester and 35% Wool.

Adding an E-mail Signature to MS Outlook

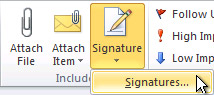

- Open a new message. On the Message tab, in the Include group, click Signature, and then click Signatures.

- On the E-mail Signature tab, click New.

- Type a name for the signature, and then click OK.

- In the Edit signature box, type the text that you want to include in the signature.

- To format the text, select the text, and then use the style and formatting buttons to select the options that you want.

- Click

Picture, browse to a picture, click to select it, and then click OK. Common image file formats for pictures include .bmp, .gif, .jpg, and .png.

Picture, browse to a picture, click to select it, and then click OK. Common image file formats for pictures include .bmp, .gif, .jpg, and .png.

Vehicle Insurance: What’s in it for you?

India has moved far beyond times when a vehicle was considered a tool. Today, a vehicle is nothing less than the owner’s pride. Given that vehicles are treated more like assets, ABC General Insurance offers you well rounded coverage to keep your vehicle shiny and new, always.

At ABC General insurance we understand the financial constraints of effectively maintaining a vehicle. This coupled with the passion of wanting to maintain it well, makes it quite an expense! ABC’s Vehicle Insurance affords you the luxury of Cashless Repairs at over 2100 network garages. What’s more? All of our Vehicle Insurance products come with the option of adding a personal accident cover of up to Rs. 10 lakh! We also reimburse towing charges and arrange for surveys to be conducted within 48 working hours of an accident or incident.

In keeping with ethical business practices, we at ABC General Insurance believe in disseminating as much information as possible, about our products, to our prospective clients prior to purchase. Our insurance products cover you for Accidents, Fire, Fire due to lightening, self-ignition, explosions, thefts and many other probable causes of loss as mentioned in the policy document.

We believe in creating value for our clients which leads us to reward you in the event that no claim is made over any one policy cycle. In such cases ABC General Insurance offers its clients a no claim bonus which entitles you to a discount on your next policy premium!

Buying an ABC Vehicle Insurance product is as easy as a few clicks on your computer. One can choose to buy our products online or through the IVR. Documentation is minimal and premium payments may be made online via Credit/Debit Card.

We look forward to your next interaction with us. Call us on 1800 3001 301 for more!

So I c hecked my credit card statement the other day and it struck me. What is ‘Over Limit Fee’ and why am I being charged it? For all of us that use credit cards, we know the service comes at a steep price. The average credit card interest rate is approximately 36% per annum which is extremely expensive given that Home Loans, Car loans and Personal Loans hover between 10 and 15% per annum. Credit card debt is by far the most expensive debt one can accumulate and is extremely difficult to get rid of.

hecked my credit card statement the other day and it struck me. What is ‘Over Limit Fee’ and why am I being charged it? For all of us that use credit cards, we know the service comes at a steep price. The average credit card interest rate is approximately 36% per annum which is extremely expensive given that Home Loans, Car loans and Personal Loans hover between 10 and 15% per annum. Credit card debt is by far the most expensive debt one can accumulate and is extremely difficult to get rid of.

The 3 most common costs one pays while playing around with credit card debt are:

- The interest payments on a monthly statement (Assuming the total due is not paid)

- A late payment fee which does get reported to Credit Rating agencies (Assuming the minimum due is not paid in time)

- Over Limit fee (Assuming a card goes over its predefined credit limit)

It is this third penalty that I will be discussing in this story. Say it once in your head, ‘Over Limit Fee.’ Do you sense an oxymoron? I am being charged a fee to go over my credit limit. Which means, if I had a $100 Credit Limit the card company does NOT extend a line of credit to me beyond $100. So if that be the case, how could I have possibly gone beyond $100? Right?

So the first time this happened to me, I called the credit card company and here’s what they had to say. They say Over Limit Fee is a penalty charged to clients that have maintained a great repayment record with the bank. To avoid the inconvenience caused by a rejected transaction on account of crossing ones credit limit, the bank authorizes a payment that breaches the card credit limit. That’s why we charge an over limit fee!

That’s the most bizarre explanation ever. I didn’t sign up for this over limit fee or the associated ‘good will gesture’ as the make it seem. In most cases like mine, people tend to lose track of their monthly swipes / charges. They never want to willfully exceed their credit limit and expect a transaction to get dishonored when a breach of credit limit is attempted.

I did a little bit of research online and it seems some seemingly ethical banks and credit card companies offer this service as optional. And when I say optional, I mean it is activated by default when the card is issued, it is up to the customer to deactivate this service. What’s worse? Most Credit Card companies, for example in a country like India, do not offer the deactivation option. Nor do they alert you when you are performing a transaction that exceeds your credit limit. It just goes through, and bang, a day later, they slap on a ‘Over Limit Fee.’ That’s a swell ‘goodwill gesture’ right?

Here’s the catch. If I have a credit card with a $100 limit on it, you can rest assured they are not going to allow transactions for more than a few dollars above the $100 limit. However, the resulting over limit fee is a lot of money!

Over Limit fee is by far one of the most unethical concepts I’ve come across.

They say all that glitters is not Gold. What could be further from the truth when the next best investment option namely Silver Bullion stares us right in the face?

They say all that glitters is not Gold. What could be further from the truth when the next best investment option namely Silver Bullion stares us right in the face?

Of late, the world is in financial trouble. They say the world is in debt a few trillion dollars. Thanks to badly managed government deficit spending coupled with a US dollar which is the world reserve currency being backed by nothing but debt and faith our purchasing power continues to slide by the day. So what’s the solution?

In a world where currency isn’t safe anymore and the US dollar is on the world of collapse, Gold and Silver, precious metals in general offer a ways out. History has it, every single fiat currency in the world has always gone back to its intrinsic value, zero. On the contrary, Gold and Silver have been used as money, a store of value for over 5000 years and continue to gain in value. For investors who think Gold is a little beyond their reach with prices hovering around $1500 an ounce, Silver offers a brilliant investment opportunity. At $30 an ounce, Silver a very undervalued and is setting itself up for an explosive rally in the near term.

Android OS Cross-Platform Development

Not very long ago, technology faced us with a grave challenge. Running a website seamlessly on multiple platforms was thought of as a herculean task, but nevertheless, we overcame. Our mobile devices today not only run these websites across multiple platforms, but are actually able to transfer settings and preferences as well.

Today however, the challenge is cross platform application development. Two of the forerunners are Google’s Android OS and Apple’s IOS with Windows and Nokia trying to push through their own Operating Systems now and then. So far, developers have been creating a app native for any one of the Operating Systems and then adapting it for different environments. This is time consuming and exhaustive, especially in the debugging phase.

With the advent of Cross Platform Development tools like Xamarin and Icenium, this issue should soon be long gone. These tools allow for a developer to seamlessly create applications across multiple platforms by programming for just one of the environments, say Android. Almost all of these tools require you to program in C#.

While solutions exist for Android OS Cross Platform Development, there still are a significant number of coders who oppose this development stating it isn’t fool proof. That being said, unless mobile device manufacturers arrive at a consensus on the kind of framework they use, Cross Platform Development tools are here to stay!

Health Insurance in India

So its official, the Fixed Income segment in India boasts of some of the best term and recurring deposit interest rates in the world, thanks to our growth numbers. But for the average middle class, is it advisable to bank just on these extremely low risk instruments?

Health Insurance in India vs. the West

Health Insurance in India has been ignored for many years. Most of the west has grown up with plans like Social Security which ensure the general well being of the population, puts them through regular health checks and covers them for treatment against inconsistencies across the board. But what about Health Insurance in India? Over the years we’ve spent concentrating on growth and development, we seem to have conveniently ignored healthcare. As a result, we have a large uncontrollable, unaudited population with no access to a common ground for healthcare. Health Insurance, hence becomes your primary responsibility.

But why?

Health Insurance helps an individual ease financial pressure in many medical situations. Based on the kind of plan it could apply to an individual or his/her entire family. Premiums for Health Insurance are payable in various modes and usually differ with age, going up as age increases. Most Indian insurance companies do not prescribe a minimum deductible on health insurance so you’re covered from the moment you’re admitted to a hospital for treatment. Furthermore, most Indian hospitals and healthcare centers are directly associated with one or many insurance companies which ensures a cashless treatment facility to the insured individual.

But I’ve never had a sore bone all my life!

That doesn’t matter, health insurance operates purely on the concept of surprise. A clean bill of health so far has little effect on the chances that might land you in trouble.

Does it cost too much?

Health Insurance is surprisingly well priced and one benefits from entering a plan early in life since your premiums start low. Furthermore, loyalty to one company over a period of time offers the insured premium benefits since the company is well aware of the individual’s medical history! Health Insurance premiums are generally deducted via direct debit from your bank, so all you need to do is make your peace with the meager premium expense.

Health Insurance, to a large extent, improves one’s quality of life. It shifts your focus from having to worry about surprise medical expenses and allows you the luxury of planning for a bigger home, better schooling or perhaps a vacation in the Bahamas. It is every bit worth considering!

Setting up POP E-mail on iPhone

Setting up POP/IMAP mail on an Apple iPhone by Hybrid Content (India) Pvt. Ltd.

Step 1: Go to system “Settings“.

Step 2: Go to “Mail, Contacts, Calendars”.

Step 3: Under accounts, touch “Add Account”.

Step 4: Choose “Other“.

Step 5: Touch “Add Mail Account”.

Setting up POP/IMAP email on an iPhone

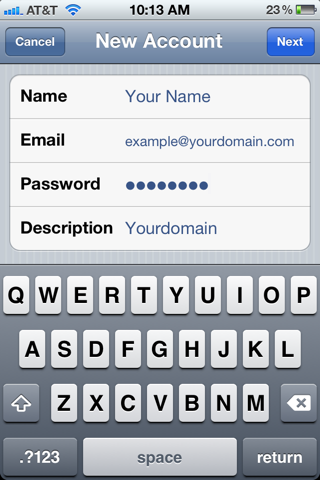

Step 6: Enter your name, full email address and password for the email account. The description field can be filled in as you see fit.

Step 7: After hitting “Next” you will need to enter in our mail server information. For hostname enter mail.supremecluster.com and for username enter the full email address. Example “you@youremailaddress.com”. If the password field is not filled in, re-enter it again.

Setting up POP/IMAP email on an iPhone

Step 8: At this point you should be all set. Make sure the settings are saved and then touch the mail icon to begin retrieving your email.